Buying Singapore Property as Foreigners

Singapore property market has always been popular and sought after by property investors from all over the world, despite the fact that it is the most expensive real estate market in South East Asia.

Comparing to neighbour countries like Indonesia, Malaysia, Thailand, Vietnam, Philippine, Cambodia and etc, the property prices in Singapore are easily several times more expensive. But that doesn’t stop foreigners from buying into properties in Singapore. In fact, many of the foreigner buyers are from those neighbouring countries.

We have discussed briefly on why buying properties in Singapore in the previous blog HERE, and will discuss more in details in future blog. In this particular blog, we would like to talk about buying property in Singapore as foreigners and what to look out for.

Types of property that foreigners cannot buy:

First, here is a list of properties that foreigners are not allow to buy

- HDB (Public Housing from government’s Housing & Development Board)

- Executive Condominium (EC): A form of condominiums under HDB board, where only Singaporean who meet the eligibility are allow to buy.

- Landed Property: Including bungalow, terraced house, semi-detached house, Good Class Bungalow, strata landed house which is not within an approved condominium development under the Planning Act, such as cluster house and townhouse.

- Vacant residential land

- Premises for worship

- Worker’s dormitory

- Association premises

- Shop house (for non-commercial use)

- Etc

What types of property where foreigners can buy in Singapore?

- Private apartment and condominium

- Landed bungalow in Sentosa (Subject to authority’s approval)

- Strata landed house in an approved condominium development

- Shop house for commercial use

- Commercial real estate like retail lots, restaurants, industrial factory, and offices

- Others

In this blog and our website, we focus on residential property. And in that case, we can say that for foreign buyers to buy in Singapore residential properties, mainly we will be looking at condominiums, apartments, certain strata landed houses, and lastly bungalow in Sentosa.

Of these, the most popular one is condominium, as it’s easier for foreigners to understand, invest, and profit from. After all, in Singapore, other than public housing (HDB), the second most popular housing option is condominium and apartment.

What are the costs involve for buying a Singapore properties as foreigners? (As of Nov 2018)

Here is a list of costs involve when foreigner buying a property here:

- Stamp duty: 4%

-

Purchase Price / Market Value of the property BSD Rates for residential properties BSD Rates for non-residential properties First $180,000 1% 1% Next $180,000 2% 2% Next $640,000 3% 3% Remaining Amount 4% – - Additional Buyer Stamp Duty (ABSD) : 20% for foreigner buyers, except foreigners from these 5 countries who are exempted from ABSD ( United States, Norway, Switzerland, Iceland, and Liechtenstein )

- Legal Fee for conveyancing (Around S$3,000)

- Income tax for rental income if investors rented out their properties.

Generally speaking, buyers do not have to pay commission to property agents. Commissions to agents are usually payable by developers/sellers.

The Additional Buyer StampDuty (ABSD) is a stamp duty imposed by IRAS of Singapore on foreign buyers, just like in other major international market like Australia, Hong Kong, New York, and London. It’s a result of overwhelming interests in Singapore properties from foreigners.

The cooling measures and stamp duty is an important measure by a responsible government to stop the property market from going into overpriced and bubble. Hence, it’s helping property investors in the long run by protecting their property value in Singapore.

Mortgage/Property Loan (As of Nov 2018 when this blog is written)

In Singapore, foreign property buyers can get a mortgage for the property they buy in Singapore, up to a maximum of 70%, subject to bank’s approval.

As a Professional Real Estate Consultant with financial background, I always encourage and advised buyers to get the mortgage, even though many of them are ultra high net worth and doesn’t require any mortgage.

The reason is because Singapore has one of the lowest interest rate for mortgage in the world, at 1.5-1.8% per annum, as compare to other countries nearby like India, Indonesia, Malaysia and others where the interest rates for mortgage is anywhere from 4% all the way to more than 10%.

The low interest environment in Singapore is in fact one of the main reasons why property investment is a favourite pastime among local investors. In finance term, it’s informally called ‘cheap money’, and I have personally seen many multi millionaires who can afford to pay the property with full cash without loan going for maximum mortgage to take advantage of the ‘cheap money’.

Where do foreigners like to buy?

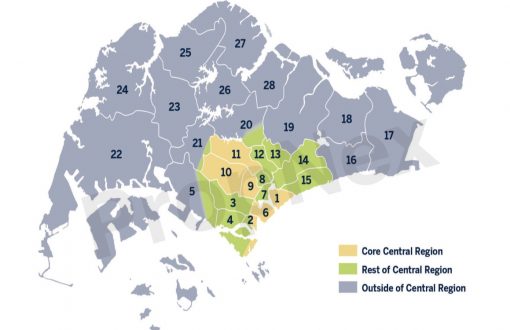

In Singapore real estate market, the number one hotspot for foreigners is in Orchard. We have discussed in details why Orchard properties are so appealing to property buyer, please go HERE for more info.

When I said Orchard, I also refer to those nearby areas of Orchard, including Ardmore Park, Nassim, River Valley, Cairnhill, Martin Place, and Balmoral.

Other than Orchard, other popular city locations are also finding favour with overseas buyers. Central Business District is one obvious choice. Central Business District in Singapore mainly consists of Raffles Place, Tanjong Pagar, and Marina Bay. However, one notable integrated development just outside of Central Business District, called South Beach, has become one of the hottest developments in town, due to its many positive factors. More info go HERE.

Another hotspot for wealthy overseas buyers is Sentosa, the most popular tourism spot in Singapore, and also a heavenly dwelling place for the rich. Some called it the “playground for the rich”. It’s also the only place in Singapore where foreigners can purchase a landed bungalow in Singapore. Bungalow in Sentosa Cove with its tranquil living environment and breathtaking sea views are some of the nicest place in Singapore to live in.

Of course, for foreigners with lower budget to invest in Singapore, they can consider to invest in more affordable condos in city fringe and outside of city locations. We have a whole segment on this affordable luxury condos specifically for property investors who do not plan to invest too much in the most prime locations. Go to affordable luxury property for more info.

In Summary:

Despite the stamp duty on foreigners, Singapore property market is still highly sought after by them. The stable political environment, strong economy fundamentals, world class education system, medical, and infrastructure, as well as progressive economy are some of the reasons why Singapore is one of the most successful countries and one of the leading financial hubs in the world.

Couple with the fact that the land is scarce and populations is increasing, it’s a country where property investors do not have to worry about oversupply and depreciation. In fact, with higher population in the pipeline and the continuously growing economy, property capital appreciation is almost guarantee in the long term.

Buying a property in Singapore is a big decision, especially if you are doing it for the first time. An experienced and professional Real Estate Consultant like us can help significantly.

If you are thinking of buying a property in Singapore, feel free to contact us HERE for a non obligated discussion and enquiry.

Regards,

Jack Ooi

Professional Real Estate Consultant (Singapore)

Contact Us HERE

Youtube Channel: https://www.youtube.com/channel/UCsttVaUP9IxNhryysHizwbg