Investing in Singapore Property (Part 3)

We discussed in previous 2 parts in “Investing in Singapore Property” on why buy property and why buy a Singapore property. In this third part, let’s talk about an important factor in any property investment: Location.

There is a famous saying in property investment that the 3 most important things are “location, location, and location!”. Although I don’t agree with it entirely, but it’s certainly true to certain extent. Location might not be the only factor when it comes to property investment, but it’s definitely one of the most important factors.

In Singapore, even though it’s a small country with world class transportation system, location is still crucial. It will determines how fast your rental property can rent out and how much of rental you can get.

So the question is, which locations to invest in?

CCR, RCR, and OCR

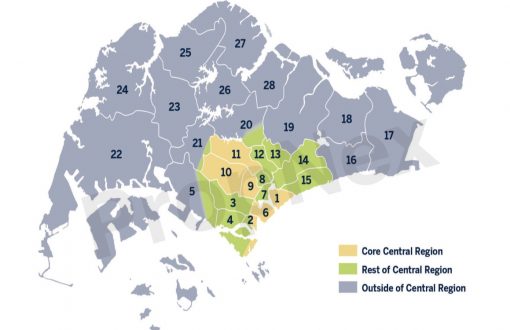

Singapore is divided into 3 regions, namely Core Central Region (CCR), Rest of Central Region (RCR), and Outside of Central Region (OCR).

- CCR: consists mainly of district 9, 10, 11 (Orchard/Newton/Bugis ) areas, downtown Central Business District (Raffles Place/Tanjong Pagar), and Sentosa. These are the most prime locations in Singapore, and are the most sought after among investors locally and internationally. Also, properties in CCR tends to be more resilient in tough economy environment.

- RCR: For Rest of Central Region, usually it is consider as city fringe, where these locations are not far from city. Places like Marina Parade, Tao Payoh, Bishan, Geylang fall under RCR category. Many investors favour this category due to lower price compare to properties in CCR and therefore potentially higher rental yield.

- OCR: Outside of Central Region are locations that are far from city and therefore commanding lower property price.

For property investment purpose, investors should focus mainly on the first 2 categories, which is Core Central Region and Rest of Central Region. Why? Because there is where most of your tenants work and choose to live. If you are investing in a property for rental income, you want to invest in the locations that your potential tenants choose to live.

Where are the tenants?

Central Business District (CBD) and City:

In my personal opinion (I do not have a stat to back this up), about 50% of the expatriates in Singapore are working in Central Business District, which is at Raffles Place/Shenton Way/Marina Bay Financial District/Tanjong Pagar. This is where most of the giant financial institutions, MNCs headquarters, real estate developers offices are located.

However, it doesn’t mean expats who work in CBD will live in CBD, although some will choose to live there for convenient sake. But majority of the expats who work in CBD will choose to live in locations that are near to CBD, which include places like Orchard/River Valley, and those city fringe locations like Geylang, Holland Village, Balestier, Novena, and etc.

So one important thing to keep in mind when investing in Singapore property for rental is to make sure the location that you invest in can allow your tenant to access to CBD relatively easily and conveniently. That will widen your target audience and open more doors for your property to be able to rent out at good rental return.

Other than CBD, there are several locations where many expats work.

Other locations with lots of tenant pools:

Here is a short list of some of the places in Singapore with huge tenant pools:

- Changi Business Park: Located at Expo near to Changi Airport, many banks have their back office located there, and a lot of expats are working there

- One North/Science Park: Located near Bouna Vista, it’s a business park under JTC, where they have Fusionopolis, Mediapolis, Biopolis, and others, which generating lots of jobs. Science Parks nearby also have lots of expats based there.

- Mapletree Business City: Located at Pasir Panjang near to Vivo City and Sentosa, it’s a business park with big companies like Google based there.

- Novena Health City: With many well known and huge medical centres like Tan Tock Seng Hospital, Novena Specialist Centre, Mount Elizabeth, you can be sure many highly paid medical specialists are based here.

- Others

The purpose of knowing where the tenants work are simple, so that when it comes to buying property for rental income, you will strategise the location that you would like to invest in so as to maximise its appeal to the biggest tenant pool possible. This way, you increase the chances of your property commanding a good rental yield and reducing the vacancy period significantly.

MRT (Mass Rapid Transit):

We cannot talk about locations to invest in Singapore without talking about MRT. Simply put, 80% of the population in Singapore, both locals and expats, are using public transport, primarily MRT.

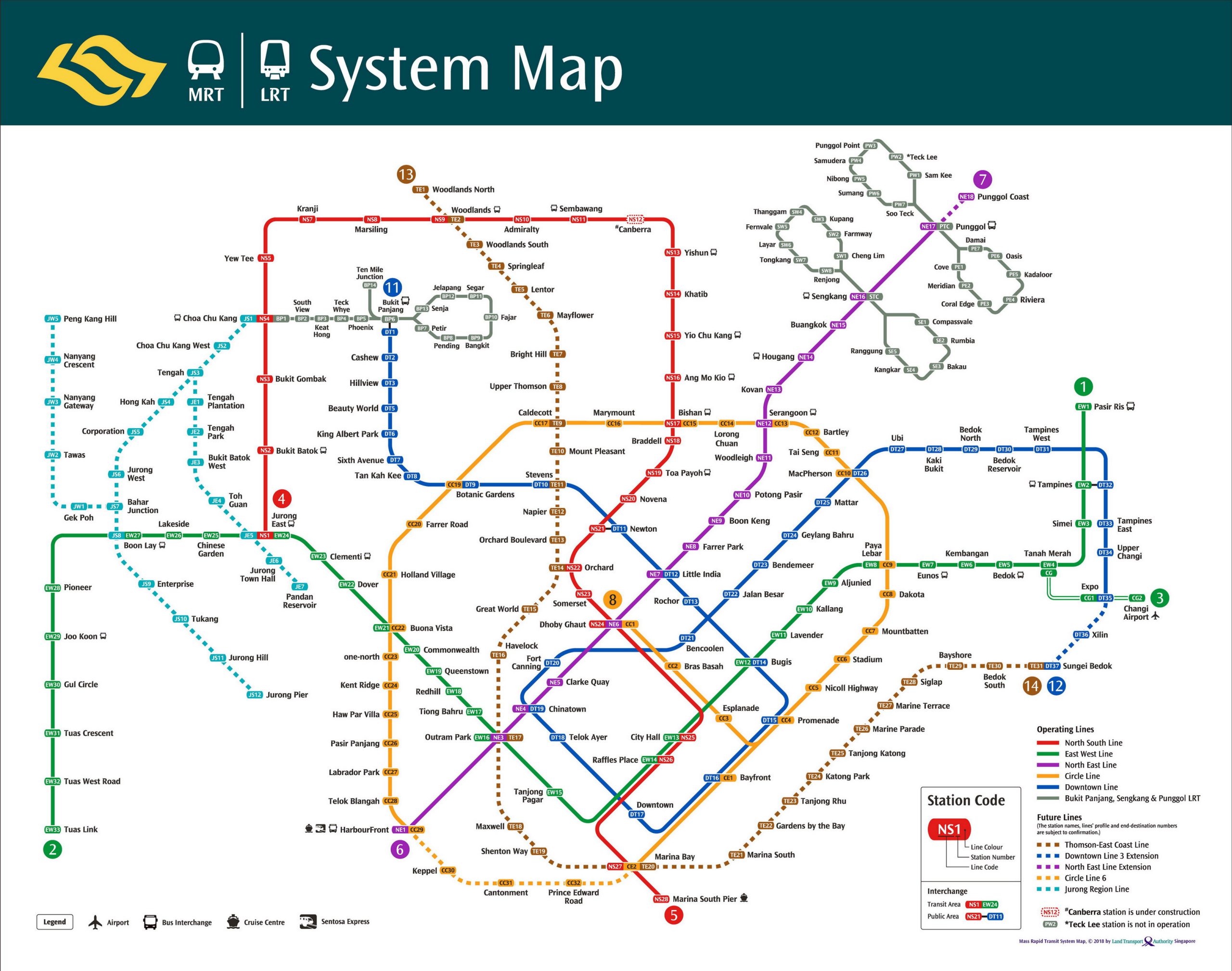

Comprising of 5 main lines as of 2018, namely North South Line (Red), East West Line (Green), North East Line (Purple), Circle Line (Yellow), and Downtown Line (Blue), the MRT system in Singapore is comprehensive and extremely well connected. The MRT system carries million of passengers on the daily basis, and form the most crucial part in the Singapore transportation system.

The comprehensive MRT system is further complemented by bus services, which literally make Singapore transportation system one of the most advanced in Asia and in the world.

Since most of your tenants who rent a property from you are more than likely taking MRT to work and getting around in Singapore, it makes perfect sense to buy property that’s near to MRT stations. In fact, base on my experience of doing rental for years, the nearer to MRT station the better.

Of course MRT is just one of the considerations, albeit an important one. When it comes to investing in property, investors should also examines other factors, such as the future master plan for that location, Comparative Market Analysis (CMA), pricing, and other important factors.

Summary:

In short, location is surely one of the key factors in property investment. And we need to know where the tenants are and plan our investment accordingly.

As mentioned, there are also other factors to consider, and a big one is URA’s Masterplan, which is the planner’s future plan for different parts in Singapore. We will delve deeper into this topic in future blog.

Feel free to contact us if you need help in buying or investing in Singapore property, we have the right expertise to help.

Feel free to contact us HERE for non obligated discussion.

Regards,

Jack Ooi

Professional Real Estate Consultant (Singapore)

Contact Us HERE

Youtube Channel: https://www.youtube.com/channel/UCsttVaUP9IxNhryysHizwbg