Why Buy Core Central Region (CCR) Property in 2023?

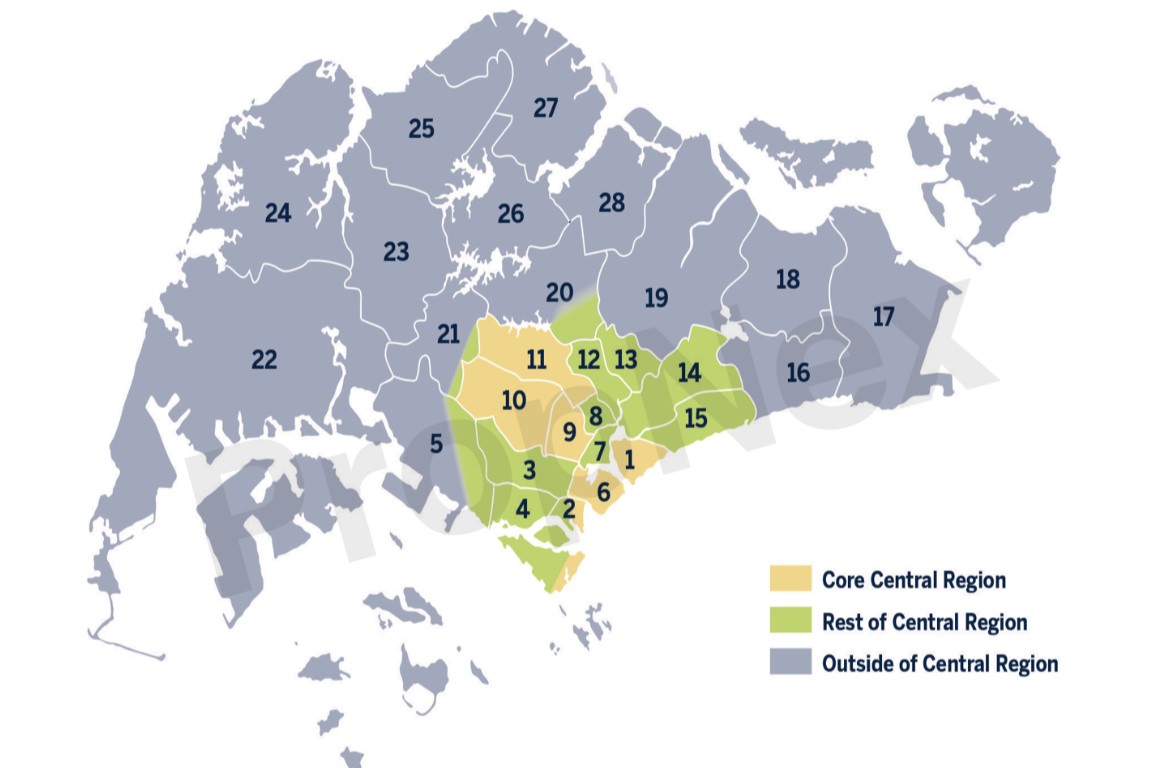

In Singapore property market, it’s divided into 3 regions, namely: Core Central Region (CCR), Rest of Central Region (RCR) and Outside of Central Region (OCR), as illustrated below:

Core Central Region (CCR) are considered the most prime locations, which is where the Singapore’s downtown and city areas are located, mostly in district 1 and 2 (Central Business District) and 9, 10, 11 (River Valley/Orchard/Bukit Timah etc). Traditionally, CCR have more investors and foreigners, and RCR and OCR have more locals and home owners.

In this blog we will share some latest research done by us on the property market (2022/2023), especially on why right now is the best time to explore and consider buying/investing in property in CCR.

CCR properties had its bull market back in 2007-2009 and before, where prices was hitting record high at that time, It was mainly due to foreigners like Indonesian and Chinese buying up properties in prime locations like Orchard. Singapore, due to its many positive qualities, including strong and vibrant economy, stable politics, and being a first world country, have always been a favourite location to buy property for foreigners, particularly those in South East Asia and China.

That resulted into property prices in CCR hitting record high back in 2007-2009 period. That prompted government of Singapore to introduce multiple rounds of cooling measures (Seller Stamp Duty, restriction on loan, Additional Buyer Stamp Duty etc) from 2010, in order to control the prices and avoiding asset bubble.

Among the cooling measures, the most deterrent of all for properties in CCR is Additional Buyer Stamp Duty on foreigners, which now (2022/2023) stands at a whopping 30%! Naturally, since all these cooling measures, prices in CCR began to stagnant or even dropped, as many of the buyers of CCR properties are foreigners who now have to fork out hefty stamp duty in order to buy.

Narrowing Price Gap Between CCR and RCR/OCR

However, despite multiple rounds of cooling measures, properties prices outside of city area, which are RCR/OCR, continue to go up consistently and sharply over the last 10+ years.

Mainly it’s because cooling measures do not really affect first time Singaporean home buyers as they do not need to pay ABSD, and also helped by the ultra low interest rate environment for the last 10 years. As most of the local buyers who are not affected by ABSD mainly buying properties in RCR and OCR, that caused the prices of properties in these 2 regions continue to go up.

As of 2021/2022, leasehold mass market new launches in outskirt (RCR/OCR) like Piccadilly Grand (Farrer Park), AMO Residences (Ang Mo Kio), Lentor Modern (Lentor), Sky Eden (Bedok) and more have all achieved average PSF of way above $2000. Upcoming launches in outskirt in 2023 will continue the trend of $2000+ average psf, due to higher cost (land, labor, construction etc) and low supply in the market.

Therefore, with the rising of prices in RCR/OCR, and the stagnant in CCR, the price gap between them have become significantly narrow over the last 5-10 years. In the past, buying a property in CCR is beyond the reach of most Singaporean, as it’s consider to be something super expensive and unaffordable, and only for those ultra rich. But fast forward to today 2022/2023, the gap between CCR and RCR/OCR have shrank to the point where many of the outskirt properties are more expensive than CCR property!

The chart below illustrated the price gap narrowing between CCR and RCR/OCR:

CCR Prices Expected to Rise in 2023 and Beyond

Because of the narrowing of price gap, many locals started to shift their attention to CCR to look for bargain, as CCR have become quite undervalued in the current market.

With the border reopening post Covid, more foreigners are also coming back to start buying properties in Singapore, especially in CCR. These 2 trends are expected to continue in 2023/24 despite the potential recession. Knight Frank Global Research team in their latest research on global property market outlook, forecasted Singapore to be potentially one of the best performing markets in the world.

Also, the most reliable factor to determine whether will prices go up or down, is the supply vs demand dynamism. Due to the high demand and low supply issues that have been around for several years, the current supply (2022/2023) in the market have dropped down to about 15,000 units (for the whole Singapore including all 3 regions), as can be seen below:

The demand on new homes are averaging about 8,000 to 10,000+ per year. With the total supply of only 15,000+ units, the demand will wipe out all the supply in the market in less than 2 years!

The shortage of supply, combined with the rising land cost, labor cost, and construction cost, will likely ensure property prices will continue to hold or going up in 2023 and beyond, despite the economy slowdown. Especially in CCR, where prices are undervalued, and more demand coming in from foreigners.

Conclusion

Above are just a small part of research done by us. We regularly conduct online webinar, live seminar, and consultation with home buyers and investors, sharing with them the extensive research on the latest market outlook and trends, as well as what are the right projects that they can explore.

My team and I specialise in Core Central Region properties, with more than 50+ projects in this region alone. Over the years, we have developed highly effective frameworks, like High Ticket New Projects Framework, and CCR Resale Buyer Framework, to assist our clients to buy the right property.

Feel free to contact us for a no-obligation discussion.

Regards,

Jack Ooi

Your Trusted Advisor for Luxury Condo (Singapore)

Contact Us HERE

Youtube Channel: https://www.youtube.com/channel/UCsttVaUP9IxNhryysHizwbg